[ad_1]

In a thread on X (previously Twitter), Raoul Pal, a famend buying and selling guru and the founder/CEO of International Macro Investor and Actual Imaginative and prescient, has illuminated the crypto neighborhood in regards to the introduction of what he phrases because the “Macro/Crypto Summer season.” This era, based on Pal, isn’t just a fleeting season however a major part within the monetary and cryptocurrency markets, deeply rooted within the cyclical nature of the worldwide financial system.

Why The Macro/Crypto Summer season Issues

Pal elaborates on the idea of the “Macro Summer season,” explaining it as a pivotal part in “The All the things Code” cycle, intently following the Monetary Circumstances Index, which traditionally precedes the cycle by roughly ten months. The ISM (Institute for Provide Administration) index, a key indicator of financial well being, typically bottoms out throughout this era, marking the beginning of GDP development.

Pal’s thesis attracts consideration to the “near-perfect 3 1/2 year cyclicality” within the ISM enterprise cycle, propelled by liquidity dynamics and the debt refinancing cycle at its core. He underscores the importance of liquidity: “And that’s pushed by liquidity, which bottomed on the finish of 2022… macro summer time and fall are all about liquidity rising and is a core a part of The All the things Code thesis.”

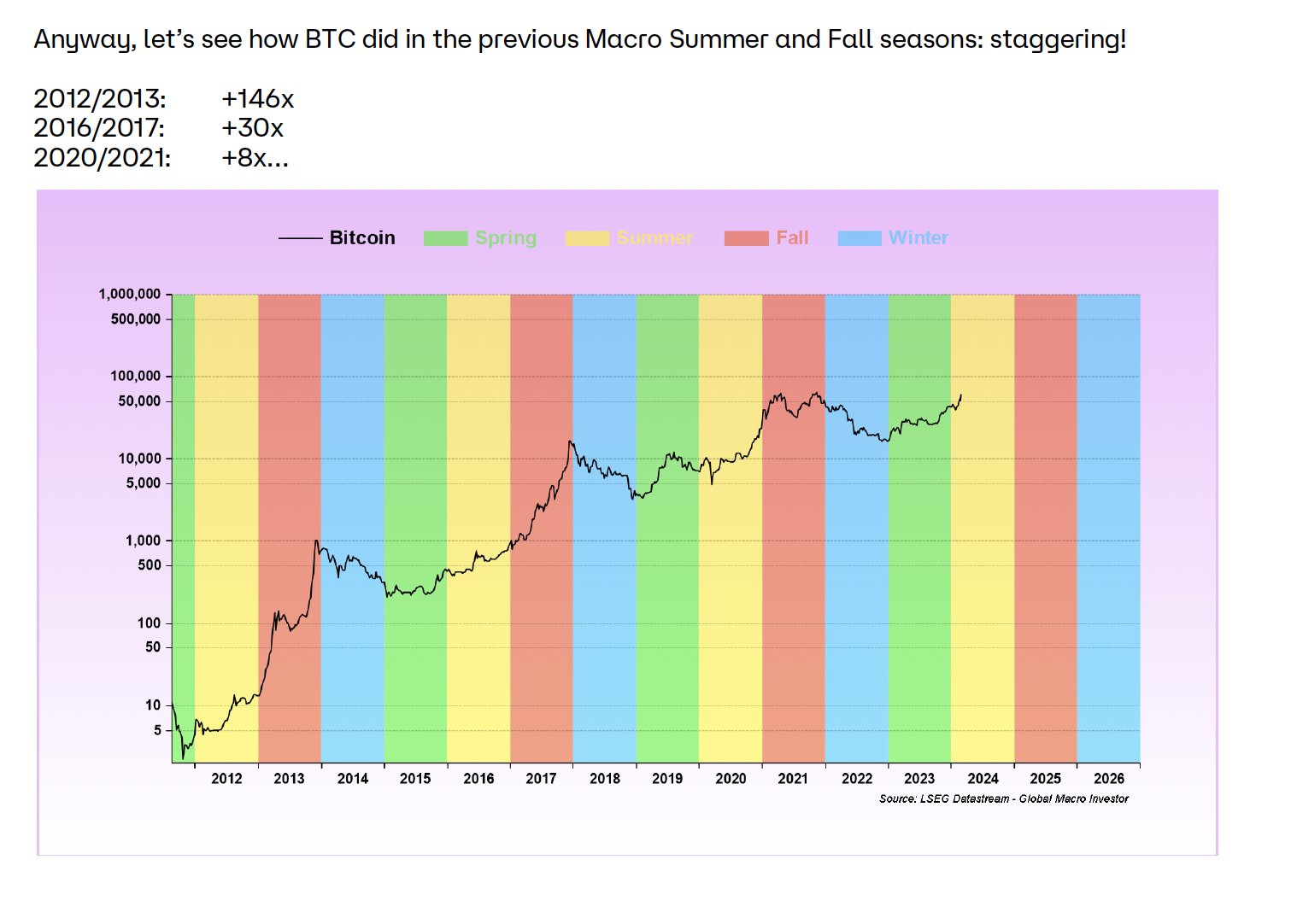

This influx of liquidity is essential for tech shares, which traditionally thrive throughout these phases. But, it’s Bitcoin and, extra broadly, the cryptocurrency market that exhibit essentially the most dramatic responses. Pal presents staggering development figures from previous Macro Summer season and Fall seasons to underscore his level:

- Bitcoin: Noticed will increase of “2012/2013: +146x, 2016/2017: +30x, 2020/2021: +8x…”

- Ethereum: As an altcoin throughout the 2016/2017 and 2020/2021 cycles, it achieved “2016/2017: +1,770x, 2020/2021: +41x.”

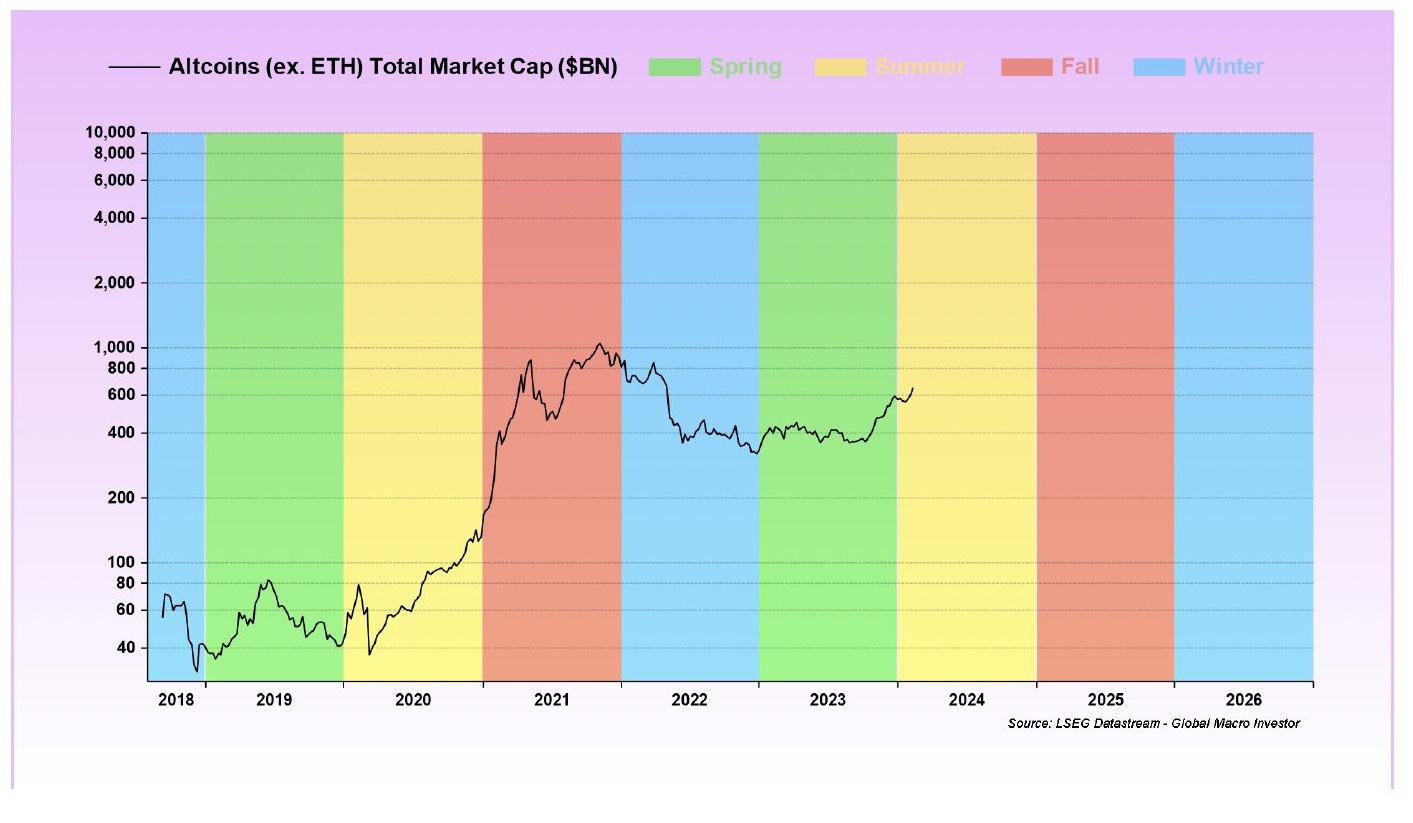

- Altcoins (excluding ETH): Witnessed an mixture market cap rise of “+24x” within the final cycle.

“Wild! Once we simply have a look at Altcoins ex-ETH (we solely have shorter knowledge for the final cycle), the whole market cap rose +24x! And that features hundreds of nugatory tokens that didn’t rise, so I’m not simply cherry-picking winners right here,” Pal remarked.

DOGE, a well-liked meme coin, is talked about by the knowledgeable as one other prime instance of the “energy of Crypto Summer season and Fall,” with its worth experiencing important multipliers – “2016/2017: +136x, 2020/2021: +370x” – within the aforementioned cycles.

These figures underline the numerous affect of macroeconomic cycles on crypto valuations, with Pal stating the alignment of those cycles with Bitcoin’s halving events. “Crypto summer time has began and absolutely develops post-halving,” he states, highlighting the interconnectedness of those cycles with the broader monetary panorama.

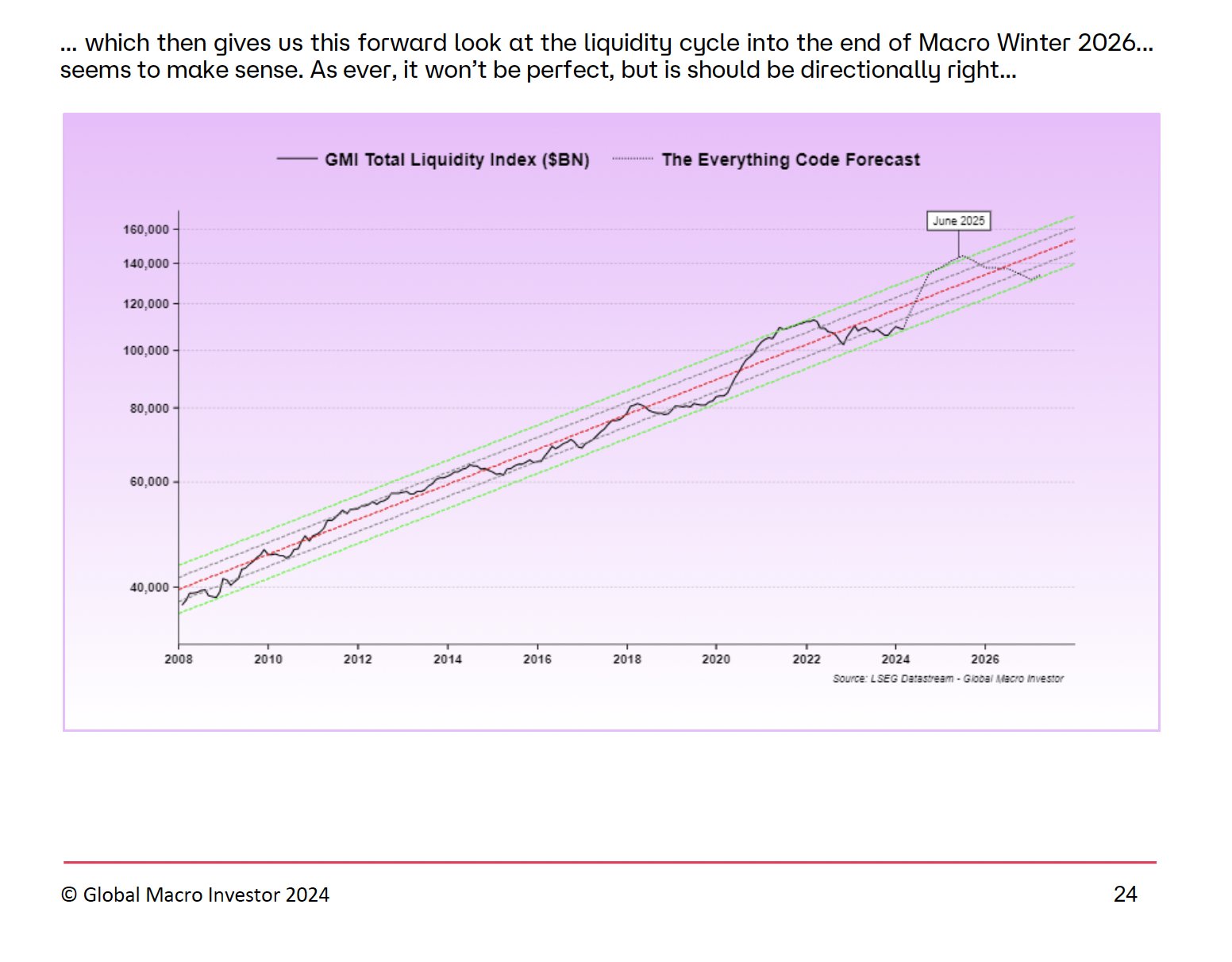

Notably, Pal’s evaluation doesn’t cease on the previous; it seems to be ahead, suggesting that liquidity is anticipated to rise all the way in which into the tip of 2025. This anticipation is rooted in a fancy interaction of worldwide monetary mechanisms, together with the potential for elevated US cash printing in response to an enormous ramp-up in curiosity funds and modifications in Fed Internet Liquidity and the Treasury Basic Account (TGA).

“Will the US be a part of the summer time occasion? […] I do know it appears inconceivable now, however the US is on the verge of an enormous ramp-up in curiosity funds. […] in some unspecified time in the future – the steadiness sheet will cease shrinking, which is sufficient to unleash liquidity into the system. […] I can not see how they don’t massively develop liquidity, a technique or one other.

In the meantime, Pal predicts that it received’t be simply the US injecting liquidity into the monetary techniques within the coming months. “I’ve no thought whether or not it’s China, the EU, Japan or the US that drives this or perhaps a little bit of all. Time will inform,” he remarked.

Pal attributes his funding methods, particularly in tech and crypto, to the insights gained from The All the things Code. This method has ready him for the unfolding Macro Summer season, with a eager eye on the altcoin market and the so-called “Banana Zone.” He concludes:

However the greater sport is but to be performed out as Alt season arrives and we absolutely enter the Banana Zone. The Banana Zone cometh, and it’s a large wealth-generating machine. Endurance will probably be rewarded. Within the meantime, don’t fuck this up. #DFTU

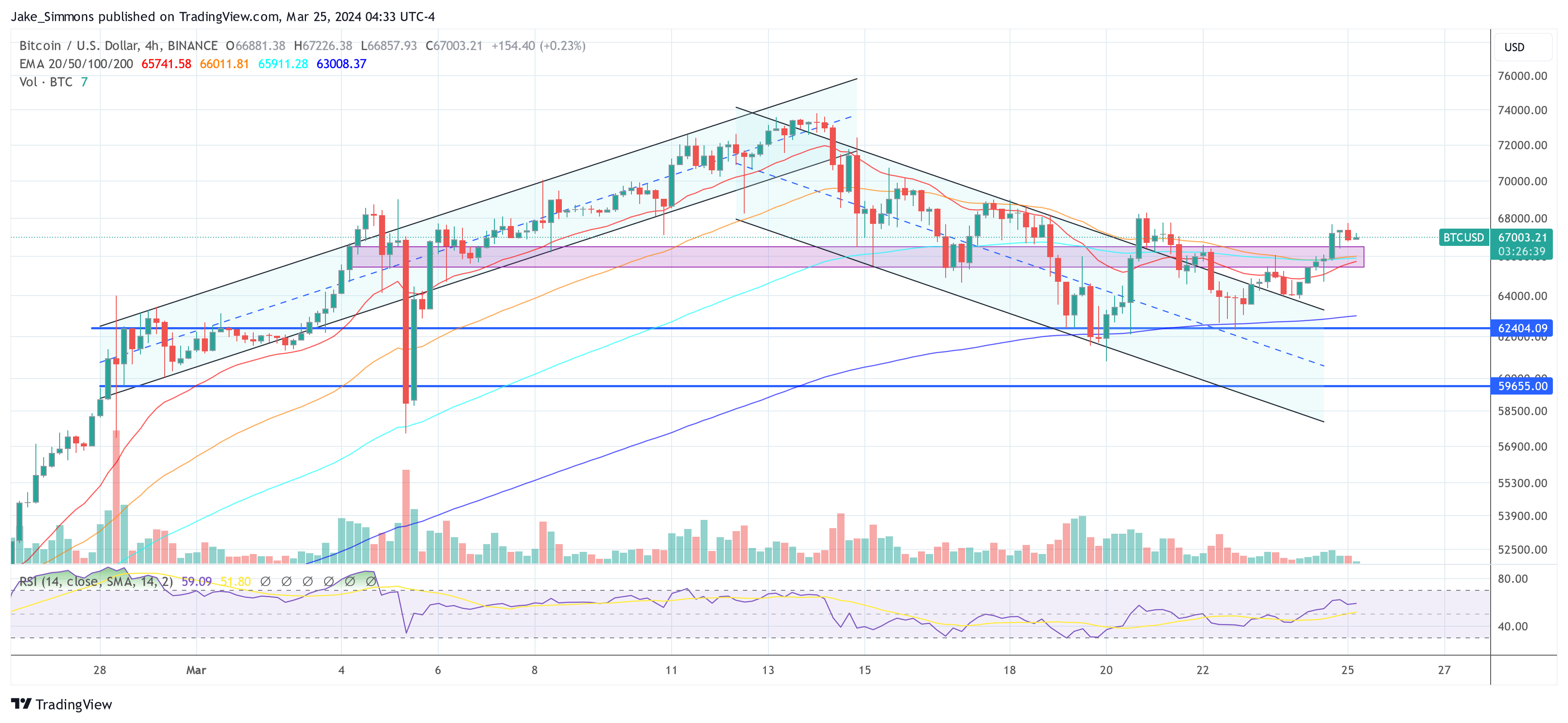

At press time, BTC traded at $67,003.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site solely at your individual threat.

[ad_2]

Source link