[ad_1]

Within the unstable world of cryptocurrencies, Binance Coin (BNB) has emerged as a powerful contender, decoupling from the market’s latest downturn. Whereas different digital property fell, BNB showcased resilience, demonstrating a worth surge in direction of a essential degree that would dictate its future trajectory within the days to come back.

On the time of writing, BNB was trading at $318, reflecting a stable 10% enhance over the previous seven days. With a market capitalization exceeding $47 billion, BNB’s efficiency overshadowed its counterparts, capturing the eye of each buyers and analysts alike.

Binance Coin On A Sturdy Ascent

Distinguished crypto analyst Crypto Tony lately underscored BNB’s ascent, emphasizing the coin’s trajectory towards a key resistance zone. If BNB manages to breach the $355 degree, there’s a excessive probability that it might set up this zone as a brand new assist degree, bolstering its prospects for additional upward motion.

Flip into assist at $355.00 and i’m right into a place. Simply holding tight for now pic.twitter.com/ZFhhbIZRWK

— Crypto Tony (@CryptoTony__) January 20, 2024

Nevertheless, the trail to larger ranges just isn’t with out its challenges. A more in-depth examination of BNB’s liquidation warmth map reveals a considerable enhance in liquidations close to $320.

Furthermore, a number of further resistance zones loom within the close to time period, performing as potential hurdles on BNB’s journey to $355. These resistance ranges embrace $320, $325, and $340, necessitating cautious monitoring to gauge BNB’s capability to surmount them.

To achieve additional insights into BNB’s potential, a complete evaluation of the coin’s day by day chart was carried out. The Chaikin Cash Circulate (CMF), which skilled a slight downtick following a pointy uptick, affords a combined sign.

BNB market cap at the moment at $47.56 billion. Chart: TradingView.com

Concurrently, BNB’s Bollinger Bands point out a shift in direction of a much less unstable zone, suggesting a possible slowdown in worth progress. Nevertheless, the MACD presents a extra optimistic outlook, with the potential for a bullish crossover on the horizon.

Binance Coin RSI Reveals Energy

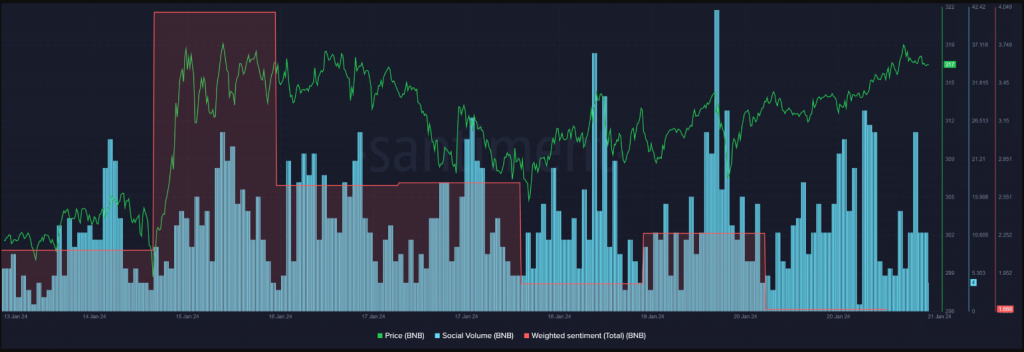

The Relative Energy Index (RSI) for BNB stays excessive, indicating a continued uptrend in its worth. Notably, regardless of these constructive market indicators, bearish sentiment stays dominant available in the market, as evidenced by a big drop in BNB’s weighted sentiment over the previous seven days.

This dichotomy between market indicators and sentiment highlights the uncertainty and cautiousness surrounding BNB’s future prospects.

Supply: Santiment

However, BNB continues to keep up its recognition throughout the crypto area, boasting a excessive social quantity. This sustained curiosity additional underscores the coin’s potential and the eye it garners from fanatics and buyers alike.

As cryptocurrency markets stay extremely unpredictable, it’s essential for buyers to train warning and conduct thorough analysis earlier than making any funding selections.

Whereas BNB’s latest efficiency and constructive indicators counsel potential upward actions, the presence of resistance zones and prevailing bearish sentiment warrant cautious commentary within the days forward.

Featured picture from Shutterstock

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site totally at your individual threat.

[ad_2]

Source link